There are many good reasons why switching to solar power is a very good idea. But some people can’t seem to be able to decide whether they should own their solar panels or lease them. One of the ways to cut your utility bills is to consider a lease contract that offers the right solar financing options.

Many companies today offer their clients the convenience of not having to wait for years before getting a return from their investment. It’s becoming obvious that people can save a lot of money when leasing their solar collectors since they don’t have to be charged the initial cost of installation. Everyone will have a chance to take advantage of solar power by renting the equipment for a small amount of money every month.

While leasing allows the homeowners to lease their solar panels, the Power Purchase Agreement (PPA) works similarly in the sense that there is no upfront cost, but instead of paying rent for the solar panels, homeowners pay per kilowatt-hour (kWh), or only for energy that solar panels generate.

Solar PPA vs the Lease — which makes better sense? The first option lets you pay a specified monthly payment for leasing the solar panels which has been approved by the finance company.

The second option lets you pay a specified rate for each kWh for all energy that you receive. You should be able to choose the best option that will best suit your needs.

How solar leases and solar PPAs work

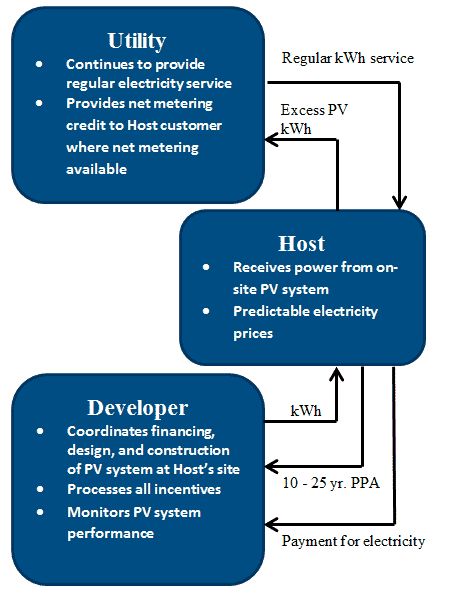

What is a Power Purchase Agreement (PPA)? PPA will allow you to only pay for the energy that your solar panels produce, similarly to how your utility company charges you. Solar panels are installed in your house so they can be used for a certain period of time (typically, a PPA is for 20 years). During this time, you will be able to use all of the solar-generated energy while making regular payments that vary based on energy usage. One attractive feature of the PPA is that if your solar panels produce less energy or don’t produce – you only pay for the energy generated.

The equipment is still owned by the solar energy provider which means that the provider is fully responsible for resolving issues with the system – specifically in the event of a malfunction or other problems. The owner, however, should maintain and inspect the system regularly. The owner can also take advantage of the benefits and discounts that come with the installation of this equipment.

General terms and conditions for solar leases and PPAs

PPA agreements differ from the Lease agreements that you enter into while renting other types of equipment. There are flexible rules and certain requirements which you can elect and pick at the time of negotiating your PPA.

The PPA program agreement includes the following:

The term for which you want to rent the equipment. Private housing of the equipment can be rented for 20-25 years. Typically, the equipment can be provided for commercial use for 7-20 years.

Solar panel production. The supplier carefully monitors the performance of all devices during the indicated rental period. Malfunctions are typically resolved very quickly, because if the system doesn’t produce, the provider doesn’t get paid.

Performance measurement. All systems of this type include a special application on your smartphone/web interface that can display real-time status and reports on the energy produced, as well as the overall performance level of provided solar panel power systems.

Lease or PPA buyout. You can gradually pay the full cost of the equipment against the rent. In this case, the system will be at your disposal after a certain time. Typically, any lease or PPA includes a buyout option that can be exercised at will.

Transferring the solar power contract to someone else. If you are planning to sell a house with the batteries installed, you will be able to buy the equipment and sell it along with the house.

This would typically require that the new homeowner qualifies for the Lease/PPA.

Another option is transferring contractual rights and responsibilities to a new operator. In this case, a new client will have to go through a specific approval process so the company can make sure that the payment will be made on time.

The residential solar PPA allows the homeowner to become a full-fledged owner of the benefit of solar generation without becoming the owner of the solar panels. If the contract expires but you don’t plan to continue using the batteries, the system will be removed from your home.

It is important to note, that in case of non-ownership solar model (Lease/PPA) the owner of the solar panels is the party eligible for the tax incentives, so if you are looking for the absolute lowest Levelized Cost of Energy (LCOE), you are better off purchasing your system out right, but if you are looking for the lowest cost of entry – PPA or a Lease may be right for you.

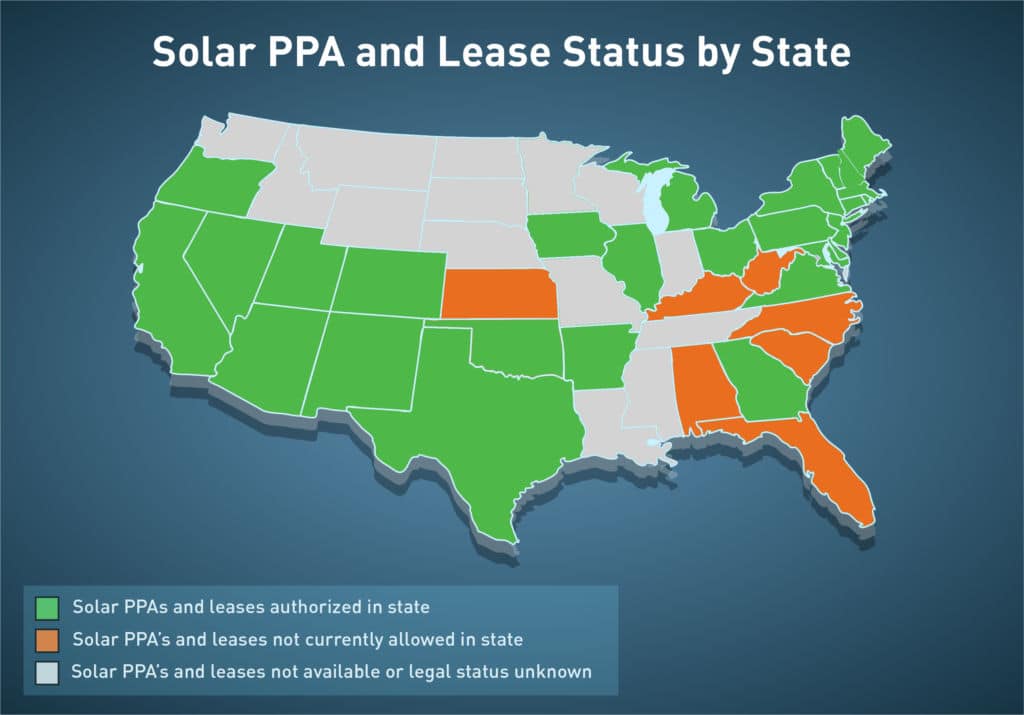

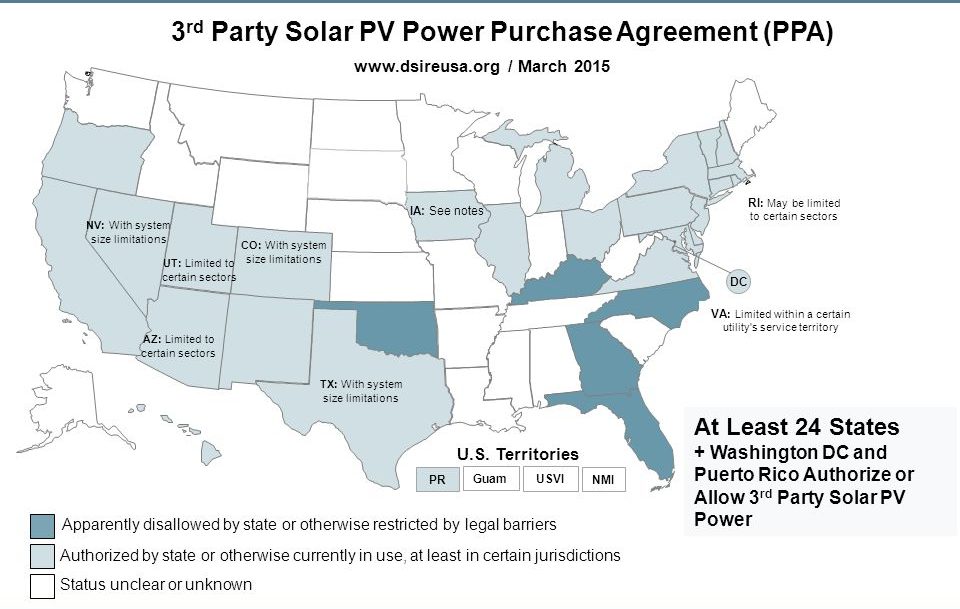

Also, please note that PPA’s and Leases are not available in all states, and are only allowed in deregulated energy markets. For example, PPA’s are not allowed or restricted in Florida, Georgia, South Carolina, and Kansas.

How PPA works:

Frequently-asked questions

Are there any differences in cost depending on the contract?

Yes, PPA and lease rates will vary based on the company/provider.

Do I need to pay a fee before installing the system?

Typically, no prepayment is required. However, at times, a buy-down option is offered to lower the monthly payments.

Can a person with a bad credit history get a Lease/PPA contract?

It depends on the provider, and may impact the Lease/PPA rates, but in general the requirements for credit are more broad in case of a PPA/Lease versus the loan option.

Additional information:

Official PPA map, sponsored by US Department of Energy: https://ncsolarcen-prod.s3.amazonaws.com/wp-content/uploads/2021/08/DSIRE_3rd-Party-PPA_Aug_2021.pdf

More about incentives in YOUR state: https://www.dsireusa.org/