Have you ever had to rely on your savings or a loan because of an emergency? Do you ever feel like your savings keep depleting due to the amount of money you spend to cover unexpected costs?

If you are regularly solving one crisis after another, such as an appliance breaks down, the HVAC unit dies or the roof needs a patch job, it might be time to look for ways to lower your expenditures and emergency spending. Here are a few tips on how to plan for the unexpected.

Rely On Experts for Quality Service

The first step is to liaise with qualified professionals every time an issue arises. Whether it’s your roof that needs a replacement, the heater is not working, or there are leaks to attend to, don’t compromise on the quality of service delivery.

While you might think a DIY fix will save you money, a professional will solve the problem and make sure it doesn’t happen over and over again. The expert will also advise you on proper care and maintenance practices that reduce emergency spendings. For instance, if you’re in Point Pleasant looking for an emergency roof repair service, don’t settle for any contractor. It’s still important to vet them properly and ensure you are getting a qualified and certified technician.

Don’t Ignore Proper Maintenance Schedules

Experts will advise you on properly taking care of various home investments such as the roof, appliances, and other installations. Most need regular maintenance practices to ensure they stay strong and last long.

For instance, the roof requires regular inspection for any signs of wear and tear. Failing to do this can lead to bigger and more expensive repairs down the road. Appliances also need proper care, including cleaning the filters and regularly checking the wires for any damage or corrosion.

Neglecting quality maintenance practices often leads to sudden breakdowns that need immediate attention, resulting in extra expenses. Follow the recommended schedule reducing chances of appliances breaking down.

Invest in Quality

Make sure any purchase you make has high-quality standards backed by manufacturer’s warranties. When working on a tight budget, choosing the cheapest offer on the market is a temptation, but always prioritize quality for long-term savings.

Poor quality products often need to be replaced sooner, which is more expensive in the long run. For instance, if you’re looking for a new roof, invest in a good quality roofing material that suits the environmental conditions in your area. Doing so could save you money, as you won’t have to repair or replace the roof as often.

If you’re not sure of a product’s quality standards, check with the Better Business Bureau, consumer protection agency, or reputable review sites. Also, only buy from reputable sources to avoid counterfeits.

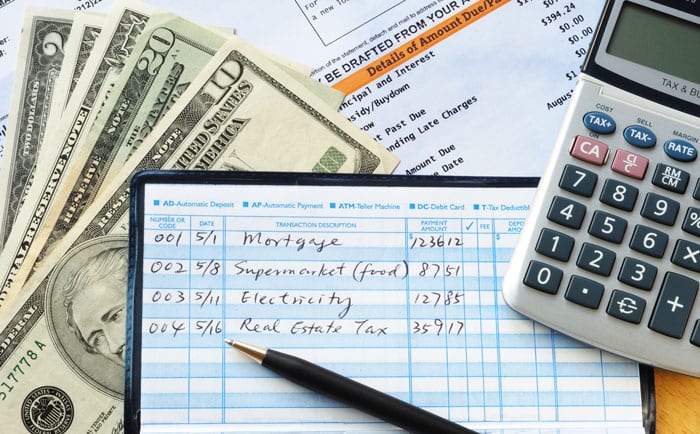

Track Your Spending

Tracking your expenditure is an important step in managing your finances, especially when dealing with emergencies. Track all the money you spend, no matter how small it might seem. The exercise will give you an idea of where most of your money goes and help identify areas you need to address.

For instance, if you notice that your monthly heating bill is abnormally high, there might be a broken seal somewhere in your HVAC system. If you have to call an emergency plumber often, there might be a blockage in the drainage system. Identifying these issues on time will go a long way in reducing expenses.

Keep an Emergency Fund

Never rely on credit cards or personal loans to solve emergencies. Keep some money ready so that you can immediately take action when something crops up. However, keep in mind that this money is only for emergencies.

Try to keep at least three to six months of living expenses in a savings account that you can easily access when needed. Note that when you take out loans or use credit cards to sort out the emergency, you pay more because of the interest rates.

If you’re moving into a new home, it pays to make sure it’s in good condition before you move in. Get a home inspection and take care of any repairs or maintenance needed. Doing so could save you from costly emergency repairs down the road.

Adopt a Healthier Financial Lifestyle

Apart from reducing emergency spending, lowering your electricity consumption, insurance premiums, and other monthly expenses can help you save money in the long term. Consider making some small changes in your lifestyle, such as turning off electronics when they’re not in use, driving less, and eating at home more often. These might seem like small changes, but they can add significant savings over time.