Every day, thousands of people make a few common mistakes in doing a property investment. Mostly, beginners make such mistakes.We have listed down the most common mistakes made by the investors.

1.Poor Legal Planning:

Property investment requires a deep knowledge of the entire real estate which is quite complex. People make the mistake of not taking professional help but investing as per their best knowledge which is not always good enough. Hence, they may incur losses. People also make the mistake of buying assets using a personal name instead of a trust, making the property open to probate in the future. It is extremely necessary for you to hire an estate planning attorney to handle such complicated affairs.

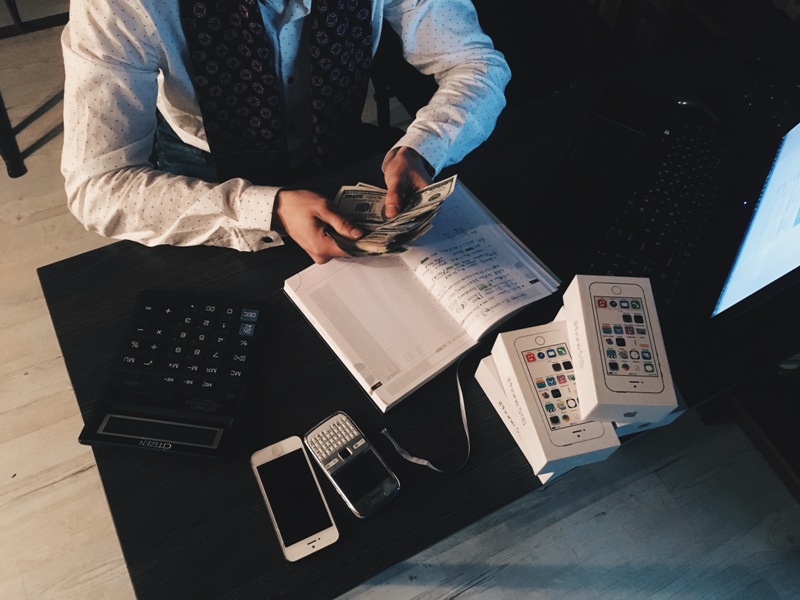

2.Poor Financial Planning:

Other than investing in the property, you also need to set aside money for your day-to-day expenditures, many investors, especially beginners fail in planning that. Also, another mistake people make is not keeping any liquid capital aside but investing the entire capital. Setting aside money for a rainy day is a must.

3.Insufficient Research:

Before any kind of real estate investment, a thorough understanding of the market is a must. People are lazy or inexperienced to do sufficient research and hence they are prone to heavy losses. They do not understand the cycle of the investment market.

4.Not Knowing Investment Goals:

Inexperienced investors do not plan their investment according to their goals or I must say, they do not plan their goals itself. Whether they need short-term profits on long-term returns is very important to analyse the kind of investments they should do.

5.Excess Loans:

Beginners do not understand the dynamics of this market thoroughly. If you have taken a loan from a bank to buy a property you have rented, and plan on paying the loan with the rent money; you need to consider factors like increase of interest rates when rent is constant or if the property is empty for a few months. Such extensive planning needs to be done before taking any loans.

6.Emotional Investments:

Many investors buy a property due to certain emotional attachments rather than logical reasoning. This is certainly not the right approach and logic should definitely overruleemotion. Do thorough research before you invest.

7.Hurry or Hesitant in Investing:

Many beginners like a property and invest in it without even sleeping on that tough. This is foolishness as buying real estate is a great deal and should be thoroughly thought upon. On the contrary, few beginners are too hesitant to buy a property hence they keep dragging the purchase and someone else steals the perfect investment from under their nose. Investing on a property should be thought upon but you should make sure that you do not take an ample amount of time. If the investment is good, be assured that other investors are eyeing on it as well.

8.Improper Life Strategy:

Most people start their investment in the late 30s whereas the ideal investment time is from the age of 25-30. There is a phase in life where investment is a good idea. Investing in early years of your life will give you enough time to grow your capital. Banks do not give loans to retired individuals and they mustpay the capital upfront hence plan your investments in the right phase of life.

It is true that we learn from our mistakes but if the mistake here refers to a mistake made in investment, then it can result in a heavy loss. A clever individual would learn from above-listed mistakes made by others as it is much less costly.