Before buying a home it is necessary to review one’s income which gives us a clear idea about affordability. In WA, as home prices continue to rise and mortgage rates creep ever higher. Though buying a home on a single income is possible in WA, but the underwriting process can be a bit trickier. The more you understand about the underwriting and mortgage loan procedure, the better you can eliminate odds which come across while buying a home and mortgage loan.

Here are four critical things that can help you in buying a home on a single income:

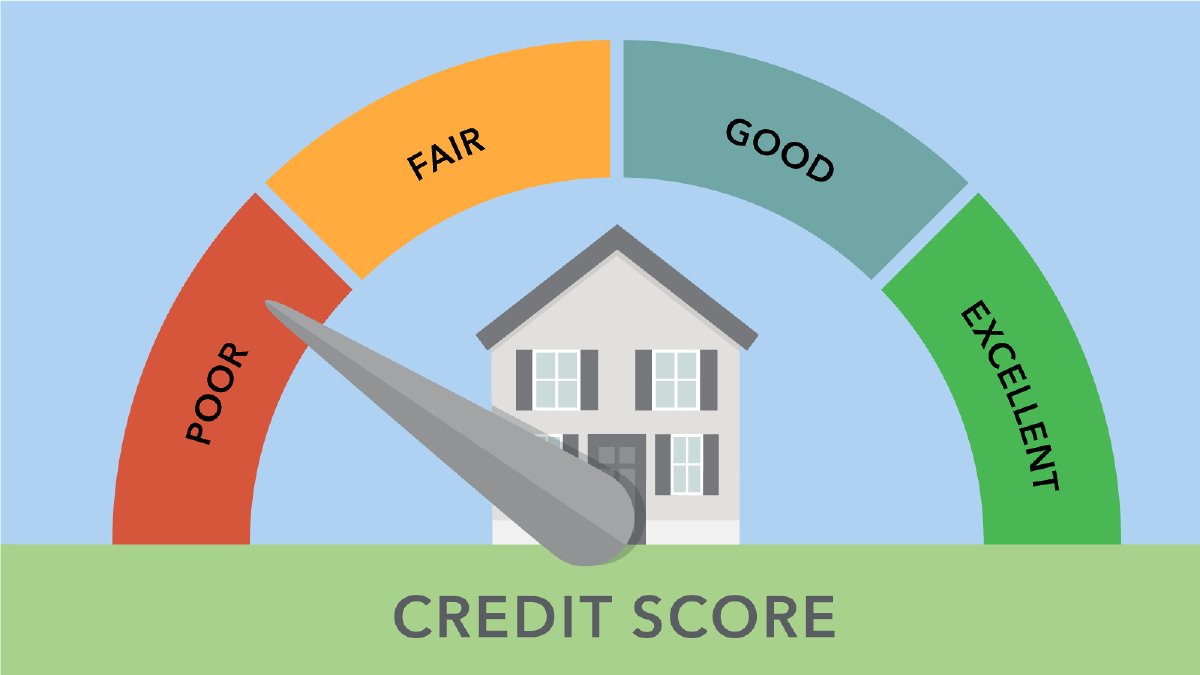

- Credit score: Credit score is an important part of the financial picture. If you want a house, you will definitely have to take out the mortgage. A good credit score can save you thousands of dollars while taking a loan and offer you a better mortgage interest rate. When you have good credit, you have access to better financial opportunities. If you are approved for a mortgage, your credit score affects the interest rates. If your credit score is more than 750 then there will be a chance you will get the loan at a lower interest rate.

- Find another source of income: Buying a home is a major financial investment. As a single person income resource, it is very difficult for you to get a loan and repay it without missing a deadline. But, if you have passive income resources you can easily pay off.

- Put someone else on loan: Having a co-borrower on a loan can sometimes help you in buying home and especially in underwriting hurdles. If you don’t have a good credit history and you unable to avail the request for a loan, then co-borrower can help you in qualifying loan.

- Mortgage loan: A mortgage is a loan from a financial institution that helps borrower purchase a house. It is secured by the home itself. If a borrower is unable to repay the amount to the mortgage company, they can sell the home to recoup the losses.

Here are the cities, where you get the most affordable homes:

#1 San Jose/Sunnyvale/Santa Clara, Calif.

- Median home price: $960,000

- Monthly mortgage payment: $4,378

- Salary required: $221,218

#2 San Francisco/Oakland/Hayward, Calif.

- Median home price: $775,000

- Monthly mortgage payment: $3,534

- Salary required: $178,588

#3 Los Angeles/Long Beach/Anaheim, Calif.

- Median home price: $592,000

- Monthly mortgage payment: $2,700

- Salary required: $136,418

#4 San Diego/Carlsbad, Calif.

- Median home price: $525,000

- Monthly mortgage payment: $2,394

- Salary required: $120,979

#6 New York, Newark/Jersey City, N.J., Pa.

- Median home price: $365,000

- Monthly mortgage payment: $1,664

- Salary required: $94,147

#7 Washington D.C./Arlington/Alexandria, Va., Md.-W. Va

- Median home price: $365,000

- Monthly mortgage payment: $1,664

- Salary required: $85,152

#8 Portland/Hillsboro, Ore., Vancouver, Wash.

- Median home price: $348,050

- Monthly mortgage payment: $1,587

- Salary required: $83,311

#9 Sacramento/Roseville/Arden/Arcade, Calif.

- Median home price: $355,000

- Monthly mortgage payment: $1,619

- Salary required: $81,805

#10 Denver/Aurora/Lakewood, Colo.

- Median home price: $360,000

- Monthly mortgage payment: $1,642

- Salary required: $81,157

Final say:

A low down payment program is a remarkable option for a single salary person. They can avail a loan on paying low down payment. If you are looking for the renowned mortgage company, get in touch with us. We are one of the leading mortgage loan providers can help single salary persons while availing a loan for buying a home.